nyc things to do manhattan brooklyn queens bronx staten island things to do events nyc

This section is dedicated to banks and loans in midtown Manhattan, the Upper East Side NYC, the Upper West Side NYC and the West & East Village NYC.

Click here to view reportmanhattan banks loans manhattan nyc

Trump Tax Plan: A Morally Bankrupt President’s Gift?

Are Billionaires Trump & Murdoch Bilking America’s Unborn Babies?

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC.

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC.

Like many of you, I have been watching the Trump Tax plan make its way through Congress. While Trump and his cohorts were whipping together the tax package, I was doing research on the possible implications of some of their tax policy proposals.

According to an October 20, 2017 PolitiFact report [based on the plan at that time, which has since been modified],

"... in the first year of changes, the top 1 percent are projected to draw a little over half the tax savings. The threshold of 80 percent going to the top 1 percent is projected for the tenth year."

While directionally this statement is likely to hold [meaning the plan is biased toward the rich], the exact numbers as to how biased the Trump Tax Plan will be for the wealthy - based on the final bill - remains to be calculated.

In this report we look at a number of tax cuts included in the final bill including repatriation of overseas profits, reduction of the estate tax, reduction of the corporate tax and the blue vs red state tax increase. We include a review questioning why the Trump Administration is pushing this deficit expanding / debt increasing fiscal stimulus package - when we're in a full employment economy with rising wages. We also include how the Trump Tax Cut Plan has been treated propagandistically by Rupert Murdoch's media outlets, as he appears to personally and corporately benefit immensely from the tax cuts.

But before we begin, we take you on a quick review at some key characteristics and prior dealings of the man behind the plan – Donald J. Trump.

- CLICK here for our report on the Trump Tax Plan a Morally Bankrupt President's Gift.

You Decide: President to Address Nation

Proposing $54 Billion Defense Budget Increase - Why?

February 28, 2017 / NYC Government / NYC Business / News Analysis & Opinion / Gotham Buzz NYC.

Tonight President Trump will address the nation regarding his plans for the U.S. One of the notable previews given by sources within the Administration is that Trump plans to increase Defense spending by $54 billion. I decided to take a quick look at some of the economic statistics to see if that appears warranted, especially vis a vis other priorities.

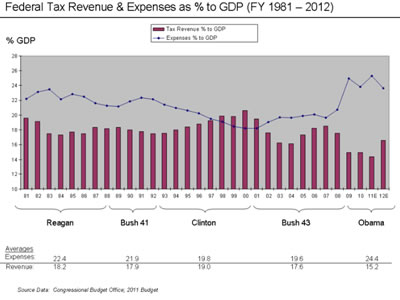

U.S. Government Deficits

The first chart [Congressional Budget Office] shows that the U.S. government has been spending more than it has been taking in. The gap widened in the wake of the September 2008 near financial meltdown, as tax receipts fell and fiscal stimulus [government spending] was needed to keep the economy going.

The higher levels of debt continued through the first term of the Obama Administration and then fell sharply back to Bush II era levels during the second term of the Obama Administration.

The net result is that near financial meltdown resulted in higher government deficits, which added to the overall U.S. government debt.

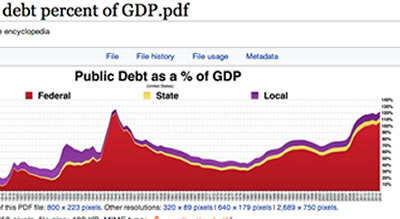

U.S. Government Debt

The second chart [Wikipedia] shows U.S. government debt relative to U.S. GDP. GDP is the acronym for Gross Domestic Product, which is a measure of the nation's economic output in goods and services.

The second chart [Wikipedia] shows U.S. government debt relative to U.S. GDP. GDP is the acronym for Gross Domestic Product, which is a measure of the nation's economic output in goods and services.

The chart shows that the overall U.S. government debt relative to GDP rose significantly in the wake of the 2008 near financial meltdown. Currently the U.S. debt level is equal to about an entire year of U.S. economic output.

Many economists think that the U.S. has an unhealthy level of debt as it doesn't provide much slack for unforseen circumstances, like the 2008 near financial meltdown or prolonged involvement addressing international crises.

U.S. Defense Spending One Third of Global Total

About Equal to the Next 8 Nations Combined

Currently the U.S. appears to overspend on military operations vis a vis the rest of the world. The U.S. military accounts for one third of defense spending in the world and its budget is roughly equal to the military budgets of the next EIGHT leading defense spenders in the world.

Currently the U.S. appears to overspend on military operations vis a vis the rest of the world. The U.S. military accounts for one third of defense spending in the world and its budget is roughly equal to the military budgets of the next EIGHT leading defense spenders in the world.

You can see this in the chart at right which was created by the Institute for Strategic Studies and published in the Washington Post.

U.S. Economy Less than a Quarter of Global Total

About Equal to Only the Next 3 Nations Combined

By contrast the U.S. economy represents less than a quarter of the global economy [versus a third of defense spending] and the U.S. economy is equal to the next THREE leading economies in the world [versus eight nations in military spending].

By contrast the U.S. economy represents less than a quarter of the global economy [versus a third of defense spending] and the U.S. economy is equal to the next THREE leading economies in the world [versus eight nations in military spending].

In the chart at right you can see the U.S. economy depicted in size versus the next eleven economies in the world. The chart was prepared by the International Comparison Program [ICP] which involves the World Bank in making its comparisons.

Does Trump Proposal to Increase Defense Spending $54 Billion Make Sense?

So my question is why is the president proposing to INCREASE defense spending, when we're spending so much more - relative to the size of our economy - than the entire rest of the world?

Click here to read the rest of our report on how out of balance U.S. Defense Spending in America is compromising the nation's economic future.

Manhattan Economy - 2016 Outlook NYC

Currently Full Employment, Low Interest Rates, Low Inflation But Possible International Shocks

January 4, 2016 / Manhattan Neighborhoods / Manhattan Business / Manhattan Buzz NYC.

January 4, 2016 / Manhattan Neighborhoods / Manhattan Business / Manhattan Buzz NYC.

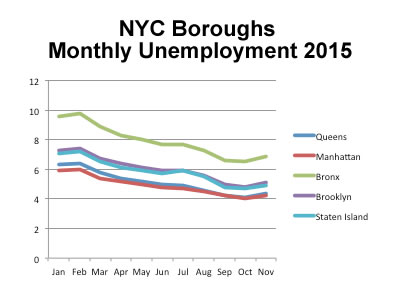

We took a look into the crystal ball over the holiday break to see what may lie ahead for the NYC economy in the coming year. We studied the stats and facts put out by many of the national data producers at the Bureau of Labor Statistics, the Federal Reserve, the Treasury Department and the AIE. What follows is a brief summary of some of the statistics we gathered on the global, national and New York City economy including unemployment statistics by borough for 2015.

U.S. & NYC Economy Near / At Full Employment

Currently Queens and Manhattan are doing the best with respect to employment, with unemployment rates below 5%, which economists consider to be full employment as the 5% unemployed are viewed as normal ‘friction’ in the economy, accounting for people coming into, leaving and changing jobs within the labor force.

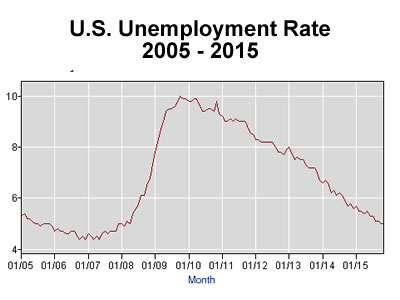

In 2009 - 2010, during the first two years of the Great Recession, the nation’s unemployment rate hit 9.4%, while the unemployment rate for New York City hit 10.4%. The employment picture for the nation and the five boroughs of New York City has slowly but steadily improved since then, with unemployment trending lower, reaching full employment this year at 5% for the nation and 4.8% for New York City this fall.

Employment Impact / Relationship to Inflation

Employment affects inflation, as when everyone is fully employed, recruiting firms bid up the price of labor and workers feel secure enough to spend aggressively, bidding up the price of goods. The Federal Reserve attempts to reign in inflation - because it creates economic instability - by raising interest rates which increases the cost of capital needed to expand operations or make large purchases more expensive. On December 16, 2015, the Federal Reserve raised its key short-term interest rate by 25 basis points (0.25%) to begin to get ahead of potentially inflationary issues that may lie ahead. We'll look into a few of these later in this report.

Employment affects inflation, as when everyone is fully employed, recruiting firms bid up the price of labor and workers feel secure enough to spend aggressively, bidding up the price of goods. The Federal Reserve attempts to reign in inflation - because it creates economic instability - by raising interest rates which increases the cost of capital needed to expand operations or make large purchases more expensive. On December 16, 2015, the Federal Reserve raised its key short-term interest rate by 25 basis points (0.25%) to begin to get ahead of potentially inflationary issues that may lie ahead. We'll look into a few of these later in this report.

Economists in one of the banking reports I received believe that there is still slack in the labor market that is not reflected in the numbers as many people have part-time jobs, while they would like full time jobs. Also the labor force participation rate fell during the Great Recession and it became more difficult to find work. Now with a full employment economy it is believed that some of those folks who gave up looking will try to re-enter the workforce. An example of the decline in participation rate might be a spouse who helped supplement household income but couldn't find the right work, and now starts looking again.

Click here to continue reading our report about the New York City NYC Economy Outlook 2016 which delves into full employment impact on inflation, interest rates, consumer debt levels, oil & commodity prices, domestic and international currencies & economic growth, the financial markets and how all of this may impact the different sectors of the Queens & New York City economy.

New York Boat Show @ Javits Center

Full Steam Ahead For Boat & Yacht Dealers & Manufacturers

January 25, 2015 / Midtown West NYC / Manhattan Business / Manhattan Buzz NYC.

January 25, 2015 / Midtown West NYC / Manhattan Business / Manhattan Buzz NYC.

For the price of a small apartment in Manhattan you can buy yourself a floating power palace with about the same amount of space, and water views on all sides.

It was my first venture into the New York Boat Show on Sunday at the Jacob Javits Center in Midtown West. There were about 400 boats and yachts on display [364 was the unoffical count] for those looking to buy, trade or just look at the state of the art in boating technology and comfort.

Again unofficially - using one of the dealer's gate count numbers - it seems attendance was up a bit this year versus last year. They surmised that the lower gas prices, the better economy and apparently a few folks were looking to replace what had been damaged or that they'd lost to Hurricane Sandy. And so it was ... show on.

Later this week I'll post a photo slide show of the event and take you onto a few of the boats and yachts so you can see what owning or riding on one of these floating palaces would look like. Ship Ahoy.

1322

Real Estate Loans - Manhattan Mortgage Market Condition

Expo Highlights Opportunities, Risks & Other Considerations

May 28, 2014 / Midtown Manhattan Neighborhood / Manhattan Real Estate NYC / Manhattan Buzz NYC.

May 28, 2014 / Midtown Manhattan Neighborhood / Manhattan Real Estate NYC / Manhattan Buzz NYC.

I attended the 2014 NYC Finance Expo at the Roosevelt Hotel on May 14th. The expo was well attended by Manhattan real estate professionals and financiers of Manhattan real estate including banks and other lenders.

The organizers had three or more seminars running simultaneously throughout the morning, with most sessions running between 20 minutes and an hour. About every 15 minutes a new session started, so there were plenty of ways to spend one's time productively.

The topics of the seminars covered a cross section of interests of those in the Manhattan real estate financial industry, from social marketing to real estate finance to real estate planning. I sat through a couple of sessions where I listened to Manhattan real estate and financial executives talk about where we are in the current cycle in the Manhattan real estate market, with an eye toward Manhattan real esate prices and valuations from a lender's point of view.

Billionaire businessman John Catsimatidis is shown in the photo at right at the NYC Finance Expo in Manhattan.

Click here to read the rest of our story about Manhattan real estate mortgage market conditions & the NYC Finance Expo.

1021

LIC Real Estate: New Face of a Changing Borough

LIC Real Estate Development Continues - Just Across From Midtown

October 1, 2013 / NYC Real Estate / Midtown Buzz. I, like many in the borough, have been watching in near amazement at the rapid pace of real estate development in Long Island City. On September 18th of 2013, I attended the Grand Opening of 4545 Center Blvd, the fifth of the six TF Cornerstone buildings to go up along the Long Island City waterfront.

October 1, 2013 / NYC Real Estate / Midtown Buzz. I, like many in the borough, have been watching in near amazement at the rapid pace of real estate development in Long Island City. On September 18th of 2013, I attended the Grand Opening of 4545 Center Blvd, the fifth of the six TF Cornerstone buildings to go up along the Long Island City waterfront.

As you will see from the photos in the slide show at the end of the story, the apartments are beautiful. The new high rise is an airy, modern building with amenities, and apartments that have breathtaking views of the Manhattan skyline and the Queensboro Bridge. I saw a studio and corner two-bedroom apartment, which rent for about $2,300 and $5,500 per month respectively – so it’s not only the views that are breathtaking, but the rents as well. Five of the six TF Cornerstone buildings along Center Blvd in LIC are rentals, and only the condominiums in The View [the only building TF Cornerstone named] were for sale.

Click here for a story about apts for sale / apartments for rent near Midtown Manhattan NYC, including a bit of the history of TF Cornerstone, Rockrose Real Estate and real estate development in the LIC neighborhood of Queens.

How The Other Half Lives

September 23, 2013 / Long Island City Neighborhood / Manhattan Real Estate / Queens Buzz NYC.

September 23, 2013 / Long Island City Neighborhood / Manhattan Real Estate / Queens Buzz NYC.

I attended a reception hosted by TF Cornerstone in late September to celebrate the official opening of their fifth property. The building had been completed earlier this year and the first tenants had moved in sometime in May. I understand they've rented about 70% of the units, so they've been moving briskly.

I visited a couple of the units for rent, including a studio that started at about $2,300 per month and a two bedroom corner that likely rented for something like $5,000 per month [give or take several hundred]. To those of us who live in Queens, these are expensive units, but to those who live in Manhattan - given the views and amenities - these are good value. Like the headline says : )

747

Small Business Loans - Manhattan Credit In NYC

Business Loans In Manhattan - Banking In Midtown, Upper East Side & Village NYC

Updated Spring 2014 / First reported Spring 2011 / Manhattan Banks & Loans NYC / Manhattan Buzz NYC.

Updated Spring 2014 / First reported Spring 2011 / Manhattan Banks & Loans NYC / Manhattan Buzz NYC.

I had occasion to attend a NYC Credit Fair at the Bulova Corporate Center in Jackson Heights. The credit fair was sponsored by the New York City Council, the New York Bankers Association [NYBA], the New York Business Development Corporation [NYBDC] and NYC Small Business Services.

And while I missed most of the credit fair, the literature I picked up on my visit was excellent. The fair occurred the morning of January 26, 2011 which was the morning of one of the numerous snowstorms we had this winter and it likely negatively impacted attendance.

This report contains information about how to obtain financial and technical assistance to: 1) make your business creditworthy, 2) make a successful loan application, and 3) find alternative sources of credit / loans for small businesses in Queens.

Click here to learn more about how to obtain small business loans in Manhattan NYC.

590

Real Estate Lending & Mortgages

Chinese American Real Estate Association

Updated Spring 2014 / Original Report May 22, 2010 / Mortgages & Loans in Manhattan / Manhattan Buzz.

Updated Spring 2014 / Original Report May 22, 2010 / Mortgages & Loans in Manhattan / Manhattan Buzz.

There was a Real Estate Expo event hosted by the Chinese American Real Estate Association [CAREA] in Flushing. This expo is an evolution of the Home Buyers Expo, which was an event they had hosted last year with a private sponsor. The Home Buyer Expo had focused on issues such as how to find a house, how to take the house into contract and how to close on the house. Last year there were ten vendors at the expo offering financial, real estate and legal services.

Real Estate Lending & Home Buying In Manhattan & NYC

We visited the expo in search of information about the state of mortgage lending in Manhattan & Queens. Given the Asians seem to be America's financiers, we thought this expo might be a good place to research this question.

In 2010 the CAREA event scope was expanded and it attracted about 40 - 50 vendors. The expo focus changed from buying a home, to buying and managing a home. Hence vendors included tax services, energy services, remodeling services as well as vendors offering financial, real estate and legal services.

Click here to read our full report about real estate finance and mortgage lending in Manhattan.

Finance - Banks & Loans In Manhattan Related Info

Click this link for promotions, discounts and coupons in Manhattan.

Manhattan NYC Related Links

Click for Manhattan Restaurants

Click for Manhattan Neighborhoods

Click for Manhattan Things To Do

Click for Gramercy Park Restaurants

Click for Manhattan Hotels

Click for New Years Parties & Restaurants

Click for Manhattan Furniture Stores

Click for Manhattan Street Fairs

Click for Manhattan Professional Services

Click for Manhattan Farmers Markets

Click for Manhattan Real Estate

Archives - TBD

Site Search Tips. 1) For best results, when typing in more than one word, use quotation marks - eg "Astoria Park". 2) Also try either singular or plural words when searching for a specific item such as "gym" or "gyms".

SEARCH

Click this link to search for something in our Manhattan Business Directory.

Click the log in link below to create an ID and post an opinion.

Or send this story to a friend by filling in the appropriate box below.